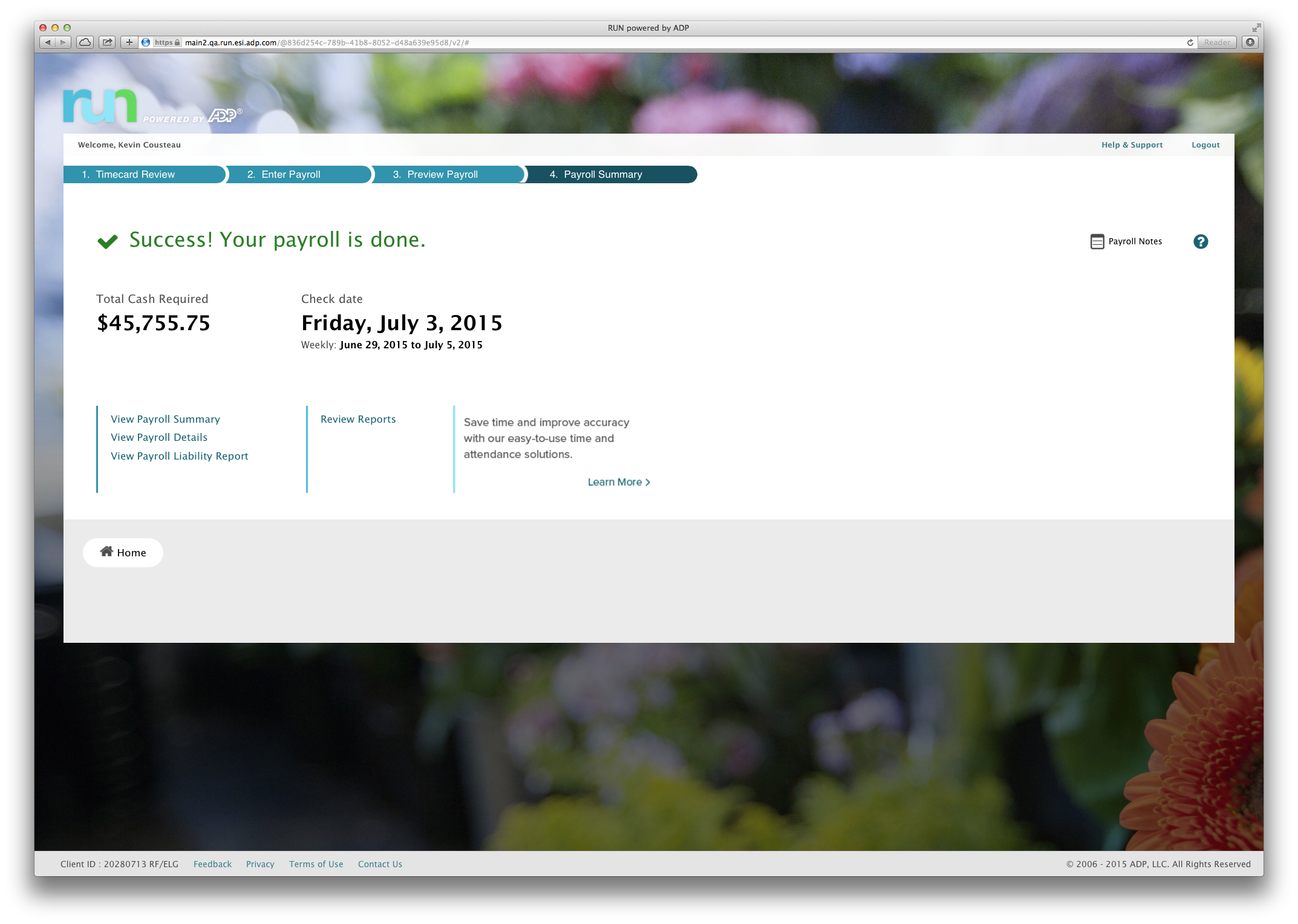

Like a traditional 401(k) plan account, a roth 401(k) plan account offers the convenience of contributing through automatic payroll deductions.

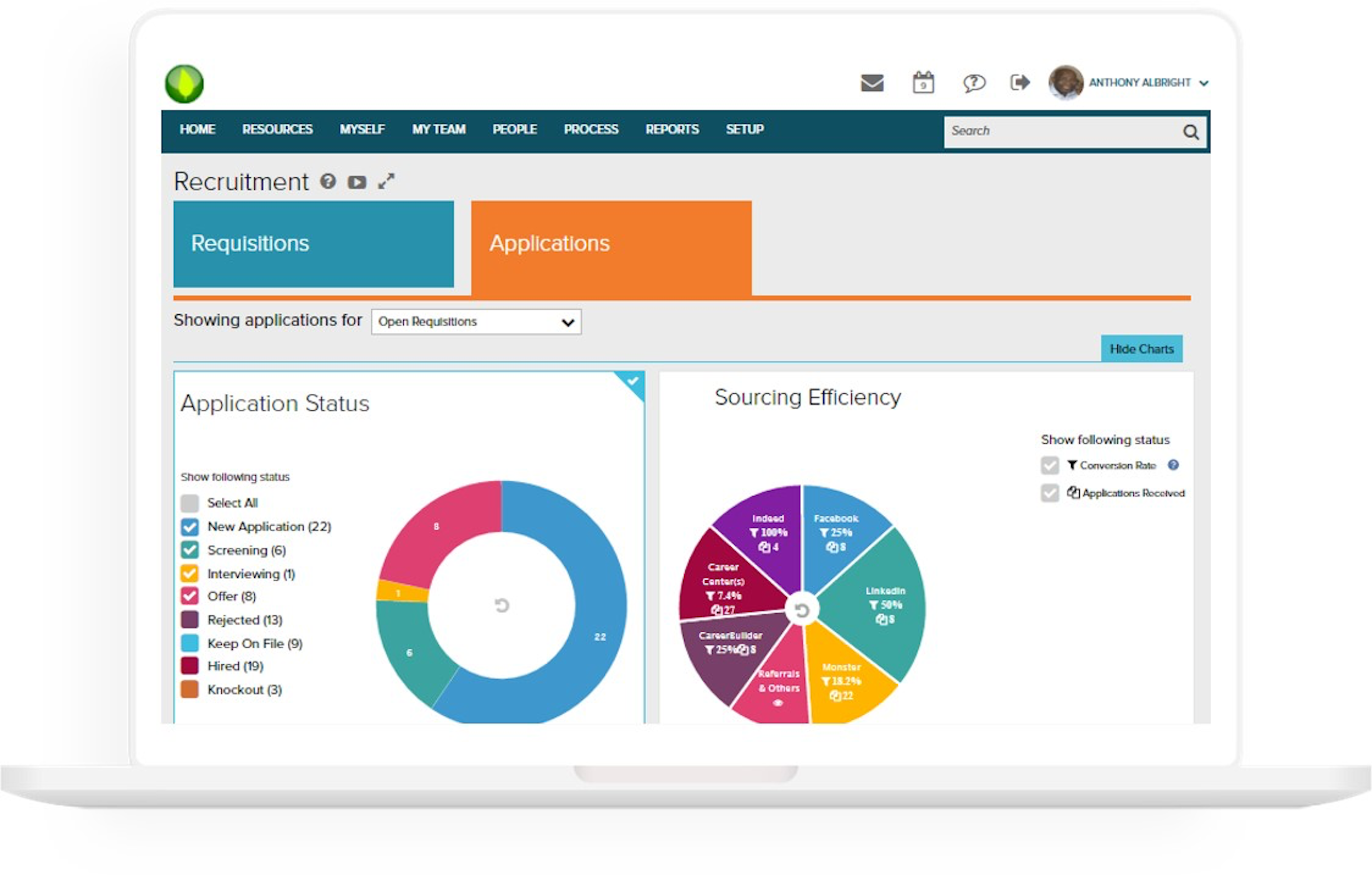

Adp Rs Employee

Like a traditional 401(k) plan account, a roth 401(k) plan account offers the convenience of contributing through automatic payroll deductions....